The stamp act of 1765

What was the Stamp Act?

The Stamp Act was a tax imposed by the British government on the American colonies. British taxpayers already paid a stamp tax and Massachusetts briefly experimented with a similar law, but the Stamp Act imposed on colonial residents went further than the existing ones. The primary goal was to raise money needed for military defenses of the colonies.

This legislative act was initiated by the British prime minister George Grenville and adopted by the British Parliament. The decision was taken on March 1765 but did not take effect until November 1st of the same year.

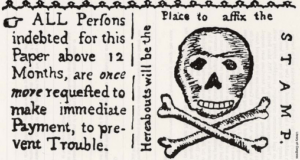

The Act imposed a tax that required colonial residents to purchase a stamp to be affixed to several documents. In addition to taxing legal documents such as bills of sale, wills, contracts, and paper printed for official documents, it required the American population to purchase stamps for newspapers, pamphlets, posters and even playing cards. The tax was payable in scarce silver and gold coins and not in paper money which was the most common method of payment in the colonies.

The British were not able to enforce the act as resistance by colonists was fierce. Congress approved thirteen resolutions in the Declaration of rights and grievances, including” no taxation without representation”, among others.

The repeal of the Stamp Act took effect on March 18th, 1766, in part because of economic concerns expressed by British merchants. To reassert their right to tax the colonies, the British Parliament issued the Declaratory Act as a reaction to the failure of the Stamp Act as they did not want to give up on the principle of imperial taxation.

The Stamp Act was a political and economic failure for the British. Politically they were facing the beginning of an organized effort to get rid of their British. Economically, the revenue collected was a mere £3,292, of which £45 came from Georgia and the rest from the West Indies, Canada, and Florida.

The Stamp Act Crisis

One of the most ardent opponents to the Stamp Act was Samuel Adams who had gained an important political ally in James Otis, a young prominent and influential lawyer of Massachusetts. The protest on the streets of Boston started as soon as they heard word of the new tax. Samuel Adams along with opposition groups from the North End and South End of Boston took their discontent to the streets organizing riots and intimidating attacks against tax collectors. These two groups were made up of tradesmen, skilled and unskilled workers, lawyers, printers, and others who put aside their differences, together they became known as the Sons of Liberty.

On August 14 the Sons of Liberty hung an effigy of Andrew Oliver, the colony's stamp distributor, from a tree on Boston Common, and subsequently paraded it through the streets of Boston. Once near Oliver's house the group lit up a bone fire where they burned the effigy, the crowd then proceeded to break Oliver's windows and throw stones at officials.

Another violent attack was the destruction of the building that was going to become the stamp headquarters. The crowd also attacked the houses of several customs officials and the house of Lieutenant Governor Thomas Hutchinson, Andrew Oliver's brother-in-law. The Stamp Act crisis for the first time drew ordinary people into transatlantic politics, even new non-English speaking immigrants who were double taxed on foreign language newspapers were involved in the protests.

From Halifax in the north to Antigua in the south anti-Stamp Act demonstrations took place in cities and towns. Everywhere in the colonies except in Georgia the Stamp masters were forced to resign and by November 1, 1765, the date the Stamp Act would take effect, not a single stamp distributor in the colonies was found on duty.

Arguments

Up until the attempt to collect the Stamp duty colonists had accepted minor duties on trade such as the Navigation Acts, Molasses Act and even the Sugar Act. The Molasses Act cost more to administer than it collected in revenue. Those measures were not considered as “tax” by the colonial assemblies but as trade regulations that compensated for protection, access to foreign products and a foreign market for American goods.

Colonists were careful to draw distinction between internal and external taxes. Internal taxes were those imposed by the provincial government, members of which were elected by residents, therefore had the power given by the people to tax them. External taxes were enacted to regulate trade of the empire.

The American arguments for opposing the British imposed Stamp duties are the following:

- The most popular view was that the Stamp Act was an internal tax levied without the consent of the colonists. Virtual representation in a faraway parliament did not guarantee the protection of colonial residents in the North American continent, therefore they lacked representation. New England was the most vocal opponent. “No taxation without representation” was in their charter of rights that had existed since 1620.

- The British had budgeted a collection of annual American revenue of twice as much as the provincial taxes raised by the provincial governments of the thirteen colonies. Colonial residents feared that it was the beginning on a series of legislation and of a heavy taxation policy that would destroy their hard-earned prosperity.

- Colonial assemblies feared a loss of authority from the British appointed officials and the establishment of an autocratic government. Salaries of officials such as governors, judges, military officers, councilors, tax collectors among others depended on colonial governments. If a tax was raised by Britain to pay for their salaries, then provincial assemblies would lose any power over them.

- Provincial governments were strong and independent institutions in the colonies, it took more than a century and much effort to get to such degree of autonomy.

- Leading political figures did not want to accept a diminished status.

- Established merchants wanted freedom to trade and any additional tax would likely decrease consumption.